Financial Aid Defined

Financial aid is money that the government and other organizations give you or lend you so you can pay for college. To qualify for financial aid, you have to apply.

What should parents know about financial aid?

Jeanette Arnhart, Latin American and Latino Studies Outreach, University of Arkansas

Sources of Financial Aid

Financial aid comes from these sources:

The federal government (the largest source)

State governments

Colleges and universities

Private organizations, such as companies, clubs and religious organizations

Banks and lending companies

Types of Financial Aid

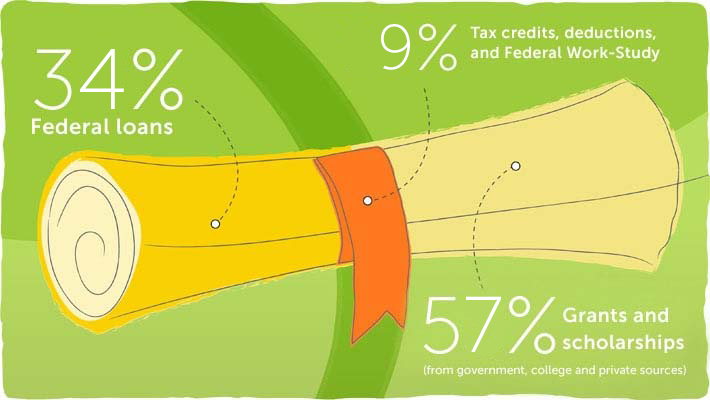

There are four main types of financial aid.

Grants

Grants are called gift aid because they do not have to be paid back. Grants come from federal and state governments and from colleges. Most grants are need based, which means they are usually given based on your or your family’s financial circumstances.

Scholarships

Scholarships are also gift aid. Scholarships come from governments, colleges and private organizations. They may be awarded for academic or athletic ability, interest in a certain subject, or volunteer work, for example. Some scholarships are given based on membership in an ethnic or religious group. Companies may also give scholarships to children of employees.

Loans

Borrowing money from a bank, government or lending company is called taking out a loan. A loan must be paid back with an extra charge called interest. The federal government offers low-interest loans to students with financial need. Other lenders charge more interest.

Our Student Loan Calculator can help you figure out how much you can afford to borrow.

Work-Study Programs

The Federal Work-Study Program offers paid part-time jobs to help students pay for part of their college cost.

Net Price

Net price is the real price that a student pays to go to a college. It’s the published price of the college minus the gift aid that the student receives. The net price of a college is often much lower than its published price.

Most colleges now offer a tool on their websites called a net price calculator. This online tool gives you an estimate of the actual price you would pay to go to a certain college, based on information you enter about your finances.

Your net price will be different for every college, so it’s a good idea to use each college’s net price calculator. Visit a college’s profile in College Search to access its net price calculator.

Most full-time college students receive some type of financial aid.

How to Apply for Financial Aid

Complete the Free Application for Federal Student Aid (FAFSA) to be considered for financial aid from the federal government, state governments and many colleges. You can also apply for financial aid directly from the colleges you’re applying to and from private organizations. Some of these may require you to submit the CSS/Financial Aid PROFILE or other forms. Both the FAFSA and CSS/Financial Aid PROFILE open on Oct. 1 each year.

Remember that meeting deadlines is your responsibility. You have to submit your applications on time to qualify for financial aid.

When to Apply for Financial Aid

Oct. 1 of the year before you plan to go to college is the first day you can file the FAFSA. College, state and private financial aid deadlines vary. Aim to file the FAFSA as close to Oct. 1 as possible; remember that financial aid dollars are limited, and in many cases are awarded on a first-come, first-served basis.

Don’t Rule Out “Expensive” Colleges

Keep in mind that a college that charges a lot for tuition might offer you generous financial aid. It might even be more affordable than colleges that charge lower tuition. So think about net price, not published price — and don’t be afraid to apply to colleges you think you can’t afford..

Once you hear from the colleges you’ve applied to, compare your financial aid offers to see which options are best for you.

No comments:

Post a Comment