University of Southern California offers 4 & 2 week summer courses in a variety of subjects where students choose - including business, journalism and law! Visit summer.usc.edu to find out more information.

Thursday, November 30, 2017

Thursday, November 16, 2017

NJIT Presents a Pre-College Financial Literacy Summer Camp for high schoolers in NJ

Students will be introduced to the world of finance and learn about entrepreneurship, financial markets, and money concepts. Those interested in Wall Street and possible futures in finance or economics are highly encouraged to attend. Also this program is free and runs from June 25th- July 19th (with 2 scheduled field trips and a one week sleep away portion).

- An overview of financial services offered by banking and investment institutions;

- The structure of the stock and bond markets;

- Principles of diversification;

- 1-2 Field Trips

- The concept of entrepreneurship;

- The fundamentals of interest rates; and

- The role of money and capital markets in supplying funds to business to fuel economic growth

More information and applications can be found at:

Financial Aid Defined

With financial aid, many students who can’t afford the full cost of college are able to earn their degrees. In fact, most full-time college students receive some type of financial aid.

Financial Aid Defined

Financial aid is money that the government and other organizations give you or lend you so you can pay for college. To qualify for financial aid, you have to apply.

What should parents know about financial aid?

Jeanette Arnhart, Latin American and Latino Studies Outreach, University of Arkansas

Sources of Financial Aid

Financial aid comes from these sources:

The federal government (the largest source)

State governments

Colleges and universities

Private organizations, such as companies, clubs and religious organizations

Banks and lending companies

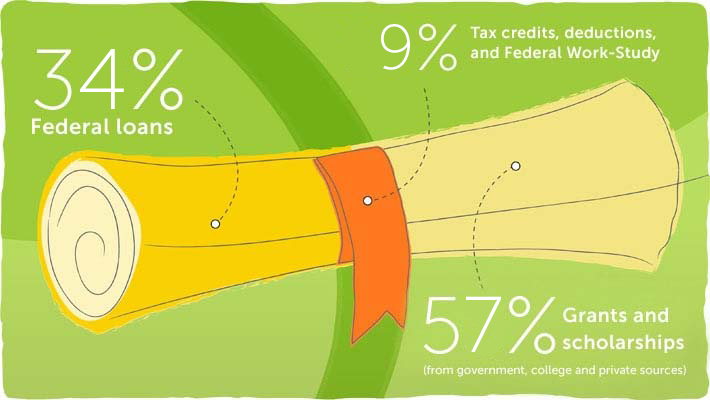

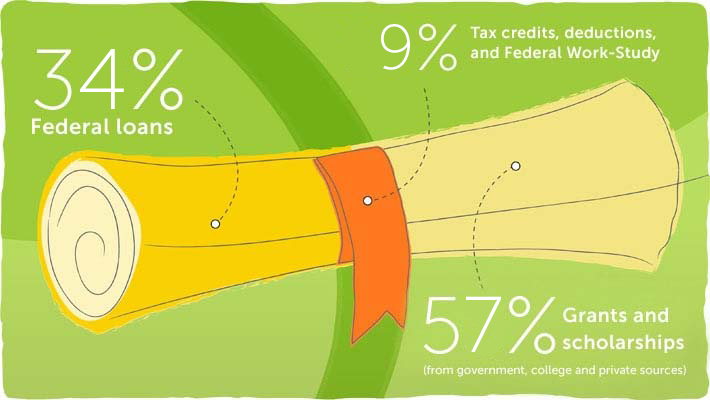

Types of Financial Aid

There are four main types of financial aid.

Grants

Grants are called gift aid because they do not have to be paid back. Grants come from federal and state governments and from colleges. Most grants are need based, which means they are usually given based on your or your family’s financial circumstances.

Scholarships

Scholarships are also gift aid. Scholarships come from governments, colleges and private organizations. They may be awarded for academic or athletic ability, interest in a certain subject, or volunteer work, for example. Some scholarships are given based on membership in an ethnic or religious group. Companies may also give scholarships to children of employees.

Loans

Borrowing money from a bank, government or lending company is called taking out a loan. A loan must be paid back with an extra charge called interest. The federal government offers low-interest loans to students with financial need. Other lenders charge more interest.

Our Student Loan Calculator can help you figure out how much you can afford to borrow.

Work-Study Programs

The Federal Work-Study Program offers paid part-time jobs to help students pay for part of their college cost.

Net Price

Net price is the real price that a student pays to go to a college. It’s the published price of the college minus the gift aid that the student receives. The net price of a college is often much lower than its published price.

Most colleges now offer a tool on their websites called a net price calculator. This online tool gives you an estimate of the actual price you would pay to go to a certain college, based on information you enter about your finances.

Your net price will be different for every college, so it’s a good idea to use each college’s net price calculator. Visit a college’s profile in College Search to access its net price calculator.

Most full-time college students receive some type of financial aid.

How to Apply for Financial Aid

Complete the Free Application for Federal Student Aid (FAFSA) to be considered for financial aid from the federal government, state governments and many colleges. You can also apply for financial aid directly from the colleges you’re applying to and from private organizations. Some of these may require you to submit the CSS/Financial Aid PROFILE or other forms. Both the FAFSA and CSS/Financial Aid PROFILE open on Oct. 1 each year.

Remember that meeting deadlines is your responsibility. You have to submit your applications on time to qualify for financial aid.

When to Apply for Financial Aid

Oct. 1 of the year before you plan to go to college is the first day you can file the FAFSA. College, state and private financial aid deadlines vary. Aim to file the FAFSA as close to Oct. 1 as possible; remember that financial aid dollars are limited, and in many cases are awarded on a first-come, first-served basis.

Don’t Rule Out “Expensive” Colleges

Keep in mind that a college that charges a lot for tuition might offer you generous financial aid. It might even be more affordable than colleges that charge lower tuition. So think about net price, not published price — and don’t be afraid to apply to colleges you think you can’t afford..

Once you hear from the colleges you’ve applied to, compare your financial aid offers to see which options are best for you.

Financial Aid Defined

Financial aid is money that the government and other organizations give you or lend you so you can pay for college. To qualify for financial aid, you have to apply.

What should parents know about financial aid?

Jeanette Arnhart, Latin American and Latino Studies Outreach, University of Arkansas

Sources of Financial Aid

Financial aid comes from these sources:

The federal government (the largest source)

State governments

Colleges and universities

Private organizations, such as companies, clubs and religious organizations

Banks and lending companies

Types of Financial Aid

There are four main types of financial aid.

Grants

Grants are called gift aid because they do not have to be paid back. Grants come from federal and state governments and from colleges. Most grants are need based, which means they are usually given based on your or your family’s financial circumstances.

Scholarships

Scholarships are also gift aid. Scholarships come from governments, colleges and private organizations. They may be awarded for academic or athletic ability, interest in a certain subject, or volunteer work, for example. Some scholarships are given based on membership in an ethnic or religious group. Companies may also give scholarships to children of employees.

Loans

Borrowing money from a bank, government or lending company is called taking out a loan. A loan must be paid back with an extra charge called interest. The federal government offers low-interest loans to students with financial need. Other lenders charge more interest.

Our Student Loan Calculator can help you figure out how much you can afford to borrow.

Work-Study Programs

The Federal Work-Study Program offers paid part-time jobs to help students pay for part of their college cost.

Net Price

Net price is the real price that a student pays to go to a college. It’s the published price of the college minus the gift aid that the student receives. The net price of a college is often much lower than its published price.

Most colleges now offer a tool on their websites called a net price calculator. This online tool gives you an estimate of the actual price you would pay to go to a certain college, based on information you enter about your finances.

Your net price will be different for every college, so it’s a good idea to use each college’s net price calculator. Visit a college’s profile in College Search to access its net price calculator.

Most full-time college students receive some type of financial aid.

How to Apply for Financial Aid

Complete the Free Application for Federal Student Aid (FAFSA) to be considered for financial aid from the federal government, state governments and many colleges. You can also apply for financial aid directly from the colleges you’re applying to and from private organizations. Some of these may require you to submit the CSS/Financial Aid PROFILE or other forms. Both the FAFSA and CSS/Financial Aid PROFILE open on Oct. 1 each year.

Remember that meeting deadlines is your responsibility. You have to submit your applications on time to qualify for financial aid.

When to Apply for Financial Aid

Oct. 1 of the year before you plan to go to college is the first day you can file the FAFSA. College, state and private financial aid deadlines vary. Aim to file the FAFSA as close to Oct. 1 as possible; remember that financial aid dollars are limited, and in many cases are awarded on a first-come, first-served basis.

Don’t Rule Out “Expensive” Colleges

Keep in mind that a college that charges a lot for tuition might offer you generous financial aid. It might even be more affordable than colleges that charge lower tuition. So think about net price, not published price — and don’t be afraid to apply to colleges you think you can’t afford..

Once you hear from the colleges you’ve applied to, compare your financial aid offers to see which options are best for you.

Tuesday, November 7, 2017

Now that most applications are in, financial aid is next! Check out these

7 Common Myths about Financial Aid

Myth #1: My family makes too much money for me to qualify for aid.

There is no income cut-off for federal student aid. Your eligibility for financial aid is based on a number of factors and not just your income. Plus, many states and schools use your FAFSA data to determine your eligibility for their aid. If you’re not sure what you will get, the best way to know for sure is to complete the application!

Myth #2: I need to file taxes before completing the Free Application for Federal Student Aid or (FAFSA).

You can use estimated information on your FAFSA so you’ll be able to submit it before you file taxes. In fact, many states and schools have financial aid deadlines well before the tax deadline. So completing your FAFSA earlier is a good idea. You might want to base your estimates on last year’s tax return, and once you file your taxes, you can log back in and update the information. You may even be able to use the IRS Data Retrieval Tool to automatically import your tax information into your FAFSA.

Myth #3: The FAFSA is too hard to fill out.

This is a very common misconception, but the FAFSA has come a long way! It’s easier than ever to complete online. The form uses “skip logic,” so you are only asked the questions that are relevant to you. And if you’ve filed your taxes, you can transfer your tax return data into your FAFSA automatically. As a result of improvements like these, the average time to complete the FAFSA is now less than 21 minutes. If you do get stuck, help is available by Web chat, e-mail and phone.

Myth #4: My grades aren’t good enough for me to get aid.

Eligibility for most federal student aid programs is not linked to your academic performance. However, you will need to maintain grades that your school considers satisfactory in order to continue receiving financial aid.

Myth #5: My ethnicity or age makes me ineligible for aid.

There are basic eligibility requirements, but ethnicity and age are not considered.

Myth #6: I support myself, so I don’t have to include parent info on the FAFSA.This is not necessarily true. Even if you support yourself and file taxes on your own, you may still be considered a dependent student for federal student aid purposes. You can determine your dependency status by answering these questions. If you are independent, you won’t need to include your parents’ information on your FAFSA. But if you are dependent, you must provide your parents’ information.

Myth #7: I already completed the FAFSA so I don’t need to complete it again.You need to complete the FAFSA every year you plan to attend college or career school. Don’t worry; it will be even easier the second or third time around since a lot of your information will be pre-populated on the application.

Millions of students complete the FAFSA each year and receive financial aid to help pay for college. Don’t let these myths stop you from achieving your goals. Take the first step by completing the FAFSA at fafsa.gov.

Tara Marini is a communication analyst at the Department of Education’s office of Federal Student Aid.

Subscribe to:

Posts (Atom)